Are You Driving Less and Enjoying Life More?

Pay-Per-Mile (PPM) and Non-Owner

Auto Insurance Can Help the Environment and Save You Money

If you're driving less these days—working from home, walking or biking more or simply rethinking car use—you could be overpaying for car insurance. That’s where pay-per-mile (PPM) auto insurance comes in. Not only can it help you save money on car insurance, but it also reduces your environmental impact. It’s a win for your wallet and the planet.

Why Pay-Per-Mile Insurance Makes Sense

Traditional auto insurance charges you the same premium each month, regardless of how many miles you drive. But for low-mileage drivers, that’s a raw deal. With pay-per-mile insurance, your cost is based on actual usage—transforming a major fixed expense into a variable cost you can control.

According to the U.S. Department of Transportation, switching to distance-based insurance can reduce annual vehicle miles traveled (VMT) by 5% to 10%. A study by the Brookings Institution also found that U.S. drivers could cut driving by around 8% with that form of insurance.

Benefits of Pay-Per-Mile Auto Insurance

Switching to PPM car insurance offers a variety of personal, financial and environmental benefits; With such coverage you can:

Save money by driving less: Especially post-pandemic, many remote workers, retirees and students drive fewer miles. PPM insurance helps them avoid overpaying.

Reduce traffic congestion: Research in Australia shows that just a 5% reduction in cars on the road can boost traffic speeds by up to 50%.

Lower your carbon footprint: Multiple studies confirm that distance-based insurance leads to less fuel consumption and fewer emissions.

Decrease accident risk: Less time on the road means fewer collisions. A 2010 study found a direct correlation between mileage and accident claims.

Promote equity: PPM insurance is often more equitable, since lower-income drivers typically travel fewer miles. It reduces the subsidies that low-mileage drivers pay for high-mileage drivers under conventional insurance.

How Pay-Per-Mile and Non-Owner Car Insurance Work

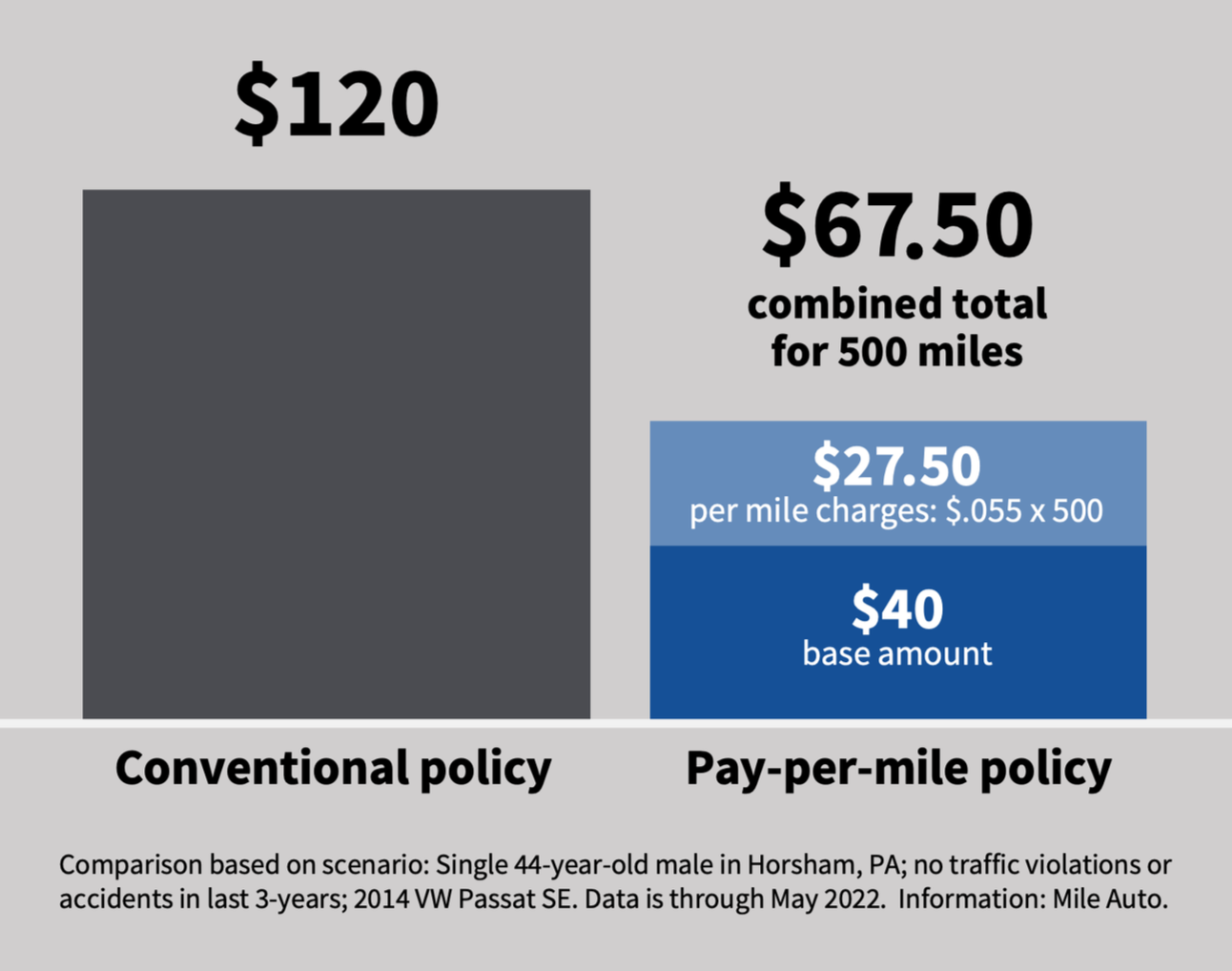

With standard insurance, your bill stays the same month-to-month (shown in the left bar of the diagram below). But with PPM (shown in the right bar), your monthly premium includes:

A base amount that is fixed

Per-mile charges that reflect the distance you drive every month

Both the base amount and per-mile charges are set by your insurer, based on factors like your age, driving record, location and vehicle type. Some insurers may also consider your credit score or insurance history.

Non-owner auto insurance is another smart, low-cost coverage alternative for people who don’t own a car but rent or use car-sharing services occasionally. Companies like Geico, Mile Auto, Progressive and State Farm offer this option.

Is Pay-Per-Mile Insurance Right for You?

You may benefit from switching to PPM insurance if you:

Drive fewer than 13,500 miles per year (U.S. average pre-pandemic)

Work from home or are a part-time commuter

Are a student or retiree

Use “green” transportation modes (bike, walk, transit)

Live in a multi-car household with one car used less frequently

PPM vs. UBI: What’s the Difference?

There are several types of distance-based car insurance:

Pay-per-mile (PPM): Your premium depends only on how many miles you drive. Companies include Allstate (Milewise), Lemonade, Mile Auto and Nationwide (SmartMiles).

Usage-based insurance (UBI): Goes further by factoring in driving behavior—speed, hard braking, time of day and location. Companies like Allstate (Drivewise), American Family (DriveMyWay), Farmers (Signal), Geico (DriveEasy), Liberty Mutual (RightTrack), Progressive (Snapshot), Root, State Farm (Drive Safe & Save), Travelers (IntelliDrivePlus) and USAA (SafePilot) offer UBI insurance. Such insurance may also be called pay-as-you-drive (PAYD), pay-how-you-drive (PHYD) or pay-as-you-go (PAYG).

Telematics, Privacy and Tracking:

What You Should Know

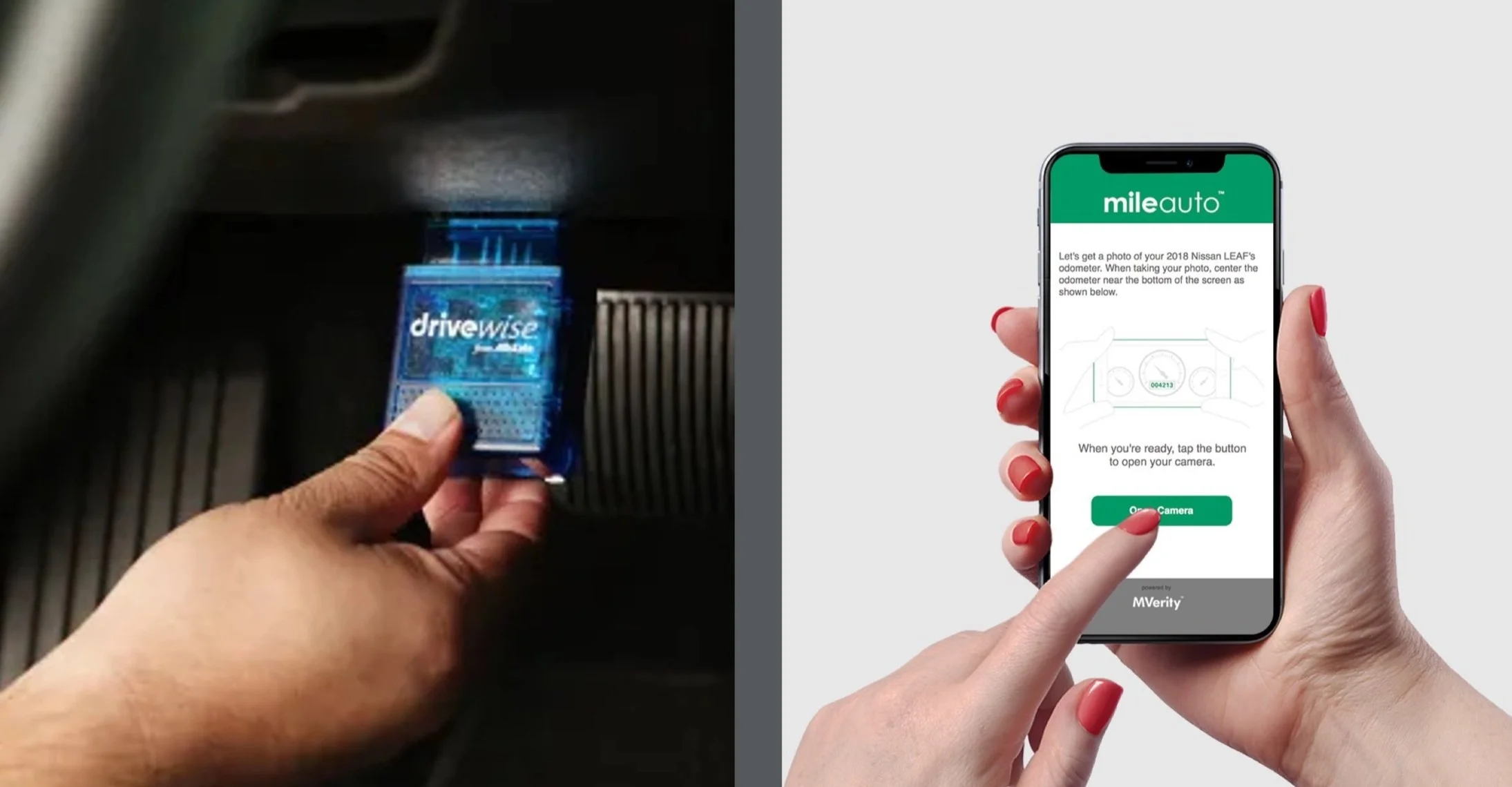

Most PPM and UBI auto insurance programs use telematics—a technology that employs GPS (short for Global Positioning System) to track your mileage and driving behavior via a plug-in device (or dongle, shown in the photo at left, below), smartphone app or built-in car sensors. While some customers like the safety insights and potential incentives these programs offer, others are wary of the privacy trade-offs.

Instead of digital tracking, one company, Mile Auto, uses a less invasive system that only monitors mileage. Here’s how it works: Your smartphone receives a text message each month, prompting you to take a photo of your odometer (shown in the photo at right, below). That image is then sent, via text, back to the insurer. That’s the only information Mile Auto collects—no GPS tracking, no speed monitoring and no driving behavior analysis. That method also lowers premiums because it cuts out the cost of hardware and data monitoring—savings that are passed on to policyholders.

Important: What to Check Before Switching

If you're shopping for eco-friendly, low-mileage auto insurance, make sure:

Your coverage levels (liability, collision, comprehensive and uninsured motorist) match or exceed your current plan

Your policy includes medical coverage for walking or biking collisions involving uninsured or hit-and-run drivers

You understand the insurer’s data privacy policies and whether they partner with third-party apps that could collect extra driving data

Also, you don’t have to wait until your policy ends to switch. Most states require insurers to refund unused premiums.

If you are a low-mileage driver, now is a great time to consider the environmental benefits and monetary rewards that come with switching to pay-per-mile or non-owner insurance. SmartGO is pleased to connect you to a licensed insurance entity to learn how much you can save in Arizona, Florida, Georgia, Ohio, Oregon, Tennessee and Texas (other states available soon). The process is easy, simple and quick.